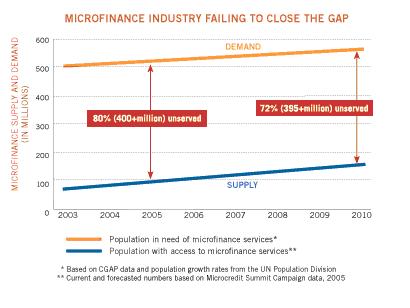

MFIs need both capital and internal operating capacity to achieve scale. Since 1970 microfinance has been proven to be one of the most effective and sustainable tools in povertyfighting. But still are 80 percent of the working poor, more than 400 million families, without reach of financial services. To be able to serve everyone the microfinance industry must be even more efficient and grow to scale. At today growth rates it will take decades for the rest 80 percent to be served.

The most critical problem today is finding money to lend out to the poor. Existing microcredit programmes are coming to a virtual halt in their expansion programme, and finding it difficult to continue their present programme because of lack of funds.

Many microfinance instituions are self-sustaining but most of the microfinance institutions still rely on and must get rid of their dependency on donor money in order to reach scale. Large amounts of money is needed to expand their operational capacity in order to reach economies of scale rapidly. Without sufficient internal operating capacity growth suddenly stops once a program reaches several thousand clients. They must provide their financial products to a much bigger amount of clients. The only possibility to access large amounts of money is on the traditional financial market. The problem for most MFIs to attract this money is the lack of track record and well formed business plans.

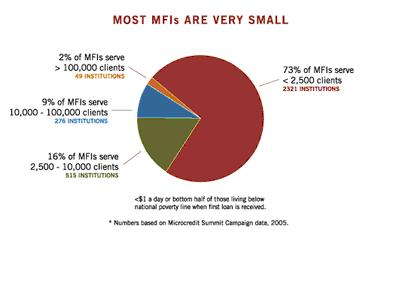

The keysolution to the right internal operating capacity includes improving for example the information technology, internal controls, new product development and human resources. When MFIs rely to much on donor money it´s very hard to do the necessary investments in the areas that are sustainable and with the possibility to expand. T hat´s why most MFIs are small and stay small which this figure visualizes. About 73% of all microfinance institutions serves less than 2500 clients.